Content

For example, investors and lenders can easily calculate the debt-to-equity ratio using the information, making them aware of what the firms own and how much they are liable to repay. This is anything due over a period of many years , including the mortgage on your building and loan payments. You can also compare your latest balance sheet to previous ones to examine how your finances have changed over time. Some practitioners are more familiar with financial terminology than others. You may find it helpful to consult a glossary of financial terms as you read this article. And though the subject of finances is tedious for many health professionals, it is crucial to be informed and to monitor the financial pulse of your practice.

- A seller of services might not use the inventories line item in its balance sheet.

- Accounts Payables, or AP, is the amount a company owes suppliers for items or services purchased on credit.

- Individuals and small businesses tend to have simple balance sheets.

Adding total liabilities to shareholders’ equity should give you the same sum as your assets. After you have assets and liabilities, calculating shareholders’ equity is done by taking the total value of assets and subtracting the total value of liabilities. You will need to tally up all your assets of the company on the balance sheet as of that date. Noncurrent assets are long-term investments that the company does not expect to convert into cash within a year or have a lifespan of more than one year.

Things to Know About Your Balance Sheet

While a business is in a growth phase, retained earnings are typically used to fund expansion rather than paid out as dividends to shareholders. It’s a good idea to have an accountant do your first balance sheet, particularly if you’re new to business accounting. A few hundred dollars of an accountant’s time may pay for itself by avoiding issues with the tax authorities. You may also want to review the balance sheet with your accountant after any major changes to your business.

What are the 3 main things found on a balance sheet?

1 A balance sheet consists of three primary sections: assets, liabilities, and equity.

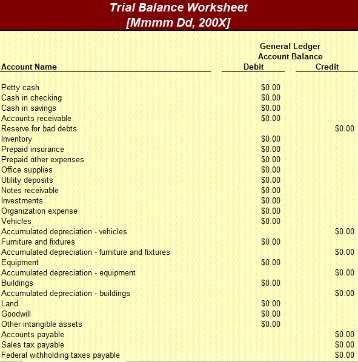

The best way to truly grasp balance sheets is to look at concrete examples. While you can create balance sheets using Microsoft Word and other word processors, you can also check out premade sample balance sheets from Accounting Coach. Whether the company has enough liquid assets to pay off its debts in the event of liquidation. Balance sheets provide clear-cut, mathematically accurate information about a company’s finances for a given moment.

Balance Sheet Ratios

And balance sheets are projected into the future for business plans or financial modeling in M&A and other decision-making. Balance sheets, income statements, cash flow statements and owner’s equity statements are four essential financial statements. A bookkeeper or the company owner may prepare the balance sheet in small companies. While most small practices use cash-based accounting, most businesses and most larger health care organizations use accrual-based accounting.

- For a sole proprietorship, shareholders’ equity may be called owner’s equity.

- This article is for small business owners who want to understand how to use balance sheets and income statements.

- The other core financial statements used in corporate finance and accounting are cash flow statements and income statements.

- Trevor is the CFO of Palo Alto Software, where he is responsible for leading the company’s accounting and finance efforts.

Owner’s equity includes common stock, retained earnings, and paid-in-capital. Including a balance sheet in your business plan is an essential part of your financial forecast, alongside the income statement and cash flow statement. The balance https://kelleysbookkeeping.com/ sheet also shows that Hometown Family Medicine Group has improved its financial condition by putting more of its cash to work during 2000. The practice improved its collections and reinvested that money in new furniture or equipment.

Showing You Understand Balance Sheets on Resumes

More specifically, a company can turn assets into cash at some point. Think of a balance sheet as a snapshot exploring what a company owns and owes and how What Is A Balance Sheet? much shareholders invest. The second source of funding, other than liabilities, is shareholders’ equity, which consists of the following line items.

By analysing balance sheet, company owners can keep their business on a good financial footing. Balance sheets, like all financial statements, will have minor differences between organizations and industries. However, there are several “buckets” and line items that are almost always included in common balance sheets. We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity.